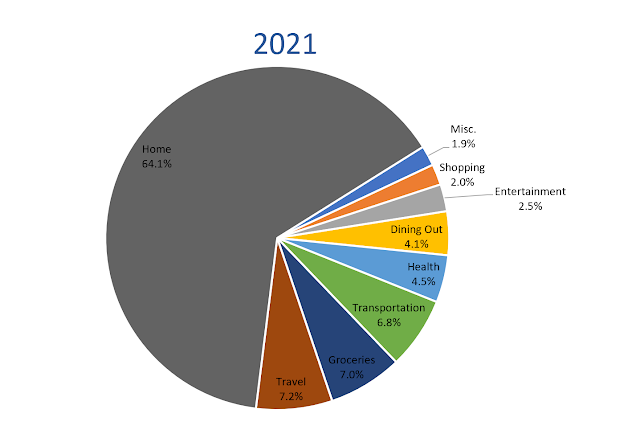

It's money pie time again! This year I spent 10% more than I did last year, mostly due to home expenses, travel and dining out as I will detail more below. Once again this year, I spent the time to itemize my Amazon, Costco and Target trips so that the categories were more accurate (at the beginning I used to just call the whole expense "groceries" or "shopping").

Home: This category includes mortgage, insurance, property tax, utilities, internet & phone. As you can see, it makes up a large chunk of my spending. Why is this? Well, I decided to refinance late in 2019, which lowered my monthly payment. Instead of spending that on something else, I decided to keep paying the same monthly amount and in 2021, I decided to add a little extra. Why do this when interest rates are so low, you ask? This could be a post in itself, but the short answer is that I am diversifying. To top it off, I had some tree work done, which is not cheap, and also had to buy a couple of other unexpected items.

Travel: This category includes airfare, car rental, lodging and any groceries, dining out or transportation incurred while traveling. In 2021, not surprisingly, I spent 110% more than I did in 2020 on travel. Of course, in 2020, I spent practically nothing, so the numbers are a bit misleading. It was still my second highest expense of the year. As I have said in years past, I am a pretty good saver, but I find travel to be one thing that is worth spending money on. I never consider it a waste of money.

Groceries & Dining Out: Although groceries was my third highest category, I actually spend 11% less on groceries in 2021 than I did in 2020. However, I made up for that in spades by spending a lot more in dining out. In fact, I was so glad to go back to eating in restaurants that I overdid myself by taking several different friends out to fancy dinners. My favorite?

Monsieur Benjamin. Oui, oui!

Transportation: This includes Lyft/Uber, public transportation, car insurance, maintenance and registration, gas, tolls & parking. It was really high because I am still driving to work, which not only entails a daily toll but the gas cost really adds up, especially in California where gas is currently over $5.00 in some places!

Health: This category includes health insurance, out of pocket costs, massages, medicines and vitamins etc. Health insurance costs went up last year (again) but I spent less in out of pocket costs. At the end of 2020, I finally canceled my gym membership, which saved me about $300 in 2021.

Entertainment: This category includes music, theater, and running & camping expenses. This year I did not spend much on this as I did not go to many events and I had a lot of camping stuff left over from last year that I could use.

Shopping: This category includes toiletries, clothing, misc. home items & appliances, pet stuff, electronics and books. The main cost in this category was office supplies, more specifically a new printer. I spent $0 on clothing.

Misc.: This category includes gifts, haircuts, fees for credit cards, taxes and education expenses. Mostly, this category was gifts, as I spent nothing on haircuts this year (I used YouTube and cut my own hair once and had a friend do it another time) and was reimbursed for my education expenses.

Well, there you have it. 2021 in a nutshell.

What did you spend the most on in 2021?

I have not done my money pie yet but without looking at it I can tell you with complete certainty that our biggest expense was daycare! But they earn that money! We paid off our mortgage in 2020 so our overall spending should be a whole lot lower! I tried to categorize my amazon and target spending last year but then gave up after a couple of months. We have an embarrassing number of transactions with those stores so I got quickly overwhelmed!

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDelete