Every Quarter Counts: Three Tips for Growing Your Wealth Early

Saving My Latte For a Rainy Day: Saving for Retirement

Make a Dollar Out of Fifteen Cents: What I Splurge and Save On

My Last To Do List: Trusts and Other Documents

The second thing that I think is important is to pay off all of your credit card debt. I did a review of a friend's finances once and the two things that really stood out to me were that (a) he had multiple charges for some subscriptions that he hadn't even realized because he was not looking at his statements and (b) he was not paying off his credit card in full every month! This can really add up!

For example, if you have a balance of $5,000 with 25% interest rate and you pay it down $100 a month ($1,200 total), by the end of the year, your balance will be unchanged, at about $5,056, and you would have paid about $1,256 in interest that year. If you pay it down $200 a month ($2,400 total), your balance would be about $3,700 and you would have paid about $1,100 in interest. You would have to pay $475 per month to get it down to $0 by the end of a year, and you would still pay about $700 in interest. That is a lot of money to pay to the credit card companies! Obviously there are emergencies, but I think putting money aside for them in advance is much more prudent.

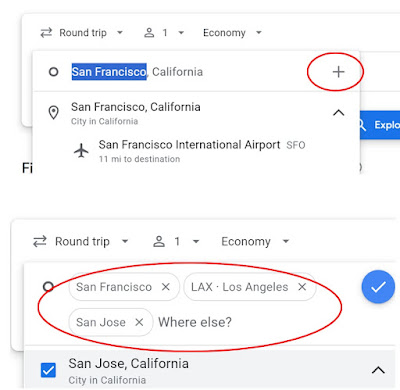

So before I begin this post, I have to throw out the disclaimer that you should not do this if you can't pay off your card in full every month. Now let's talk about credit card hacking! If you are unfamiliar with this, it involves opening a credit card to get the welcome bonus, using the points for free stuff and possibly closing or downgrading the card later. Personally I like travel related cards, and Chase has one of the best values for that, so let's talk about that first. Side note: to my foreign friends, I am sorry, but these are US centric cards. However, please feel free to go to the bottom and let us know what card you use or any tricks you have to get the best value for your money!!

Travel card ($600 - $1,500 bonus value) / $95 annual fee. The Chase Sapphire Preferred is currently offering $300 Chase Travel Credit + 60,000 bonus points (please verify by going to their site). What does this mean? Basically this can be worth anywhere from $600 - $1,500, depending on how you use it. Once you spend $4,000 in the first three months, you will get 60,000 points, and when you purchase any travel related items through their portal you will get up to a $300 credit. This includes the obvious things like flights, hotels and car rentals, but also has activities and cruises.

For the points, at the very least, they can either be used to get cash back or buy gift cards at around 0.01 per point (value of $600) or you can use them to purchase travel through the portal, which is usually about $0.015 (value of $900) or you can transfer them to airline or hotel partners, which is where you can get the best bang for your buck. For example, if you transfer these points to Hyatt and use them to book a hotel room with points, the value will be about 0.02 per point ($1,200). This card does have a $95 annual fee, but it also gives you a $50 annual statement credit for hotels booked through their travel portal, so if you use this, it is only $45/year. This card also gives higher points per dollar in categories like travel and dining out and has no foreign transaction fees.

In conclusion, if you travel at least once a year, this card may be a great fit for you! And if you don't love it after a year, you can cancel or downgrade to a no fee card. Basically with the current welcome bonus, you could stop using it after you get the bonus and still get value out of it for approximately six years (or more). If you travel a lot, you may want to go with the Chase Sapphire Reserve which gives you extra perks like lounge access and TSA Pre/Global Entry, but comes with a higher annual fee.

Cash back card ($200 bonus value) / $0 annual fee. If you don't really travel a lot or you don't spend a lot on travel related items, you can get the Freedom Flex card, which currently has a welcome bonus of $200 after you spend $500 on purchases in the first 3 months. It gives you 5% cash back for a quarterly rotating bonus category, which includes groceries, gas, Amazon and pet services, which if you max this out, could equate to $300 per year. It has no annual fee and a 0% introductory APR. There are tons of different cash back cards with different % for different categories, so a combo of best bonus + best % for what you spend on is the way to go!

Hotel card ($500 - $1,000 bonus value) / $99 annual fee. If you travel at least once a year and stay in at least one hotel/motel per year, I highly suggest getting a hotel credit card. I think the current best bang for your buck is either the IHG Premier or the Hyatt card. Let's talk about the IHG card. This is good for hotels like the Holiday Inn, Intercontinental and Staybridge Suites (list here). The good thing about IHG is that they are literally everywhere, versus places like Hyatt and Marriott which are sometimes pretty few and far between (or very expensive).

It currently has a 140,000 point bonus (please verify by going to their site), which they state is up to 4 nights free, but I just booked a Holiday Inn Express in Strasbourg for ~24,000 points per night, plus with this card you get the fourth night free, so my four nights cost me 71,000 points, so this could possibly be more like eight hotel nights (or more in places like SE Asia or South America). If I would have paid for this room, it would have cost me about $500, which means that if I can book another at the same price, the welcome bonus would be worth about $1,000. In addition, you get an annual free night's certificate, which is good for up to 40,000 point hotel, which could equate to a value of about $200. This card does cost $99 per year, but if you use your certificate for a $200 hotel, it still "saves" you money! Last but not least, you get automatic Premier Elite status, which can give you perks like upgrades, early check in, late check out, and possibly a snack or a drink. Once again, if you decide this is not for you after a year or two, you can downgrade to a no fee card with no ding on your credit, or you can cancel if you choose.

One last thing I want to talk about is a card that does not currently offer a bonus so is not really one for "hacking," but could be a great option for people who pay rent and that is the Bilt Rewards card. Please note that I have not used this myself, so you will have to do your own research. However, my understanding is that you can use it to pay your rent with no credit card transaction fees, even if you normally pay by check (they will issue the check for you) and you will get one point per dollar spent on rent plus extra points for other categories on rent day (the first of the month). You also get points for travel and other categories and it has no annual fee. You can then use the points for free travel, to pay part of your rent or for gym memberships etc. FYI currently a RT flight to Europe in Feb would cost about 40,000 points.

Have you fallen asleep yet? No? Great, because one other thing I want to add is that if you do travel, many of these credit cards also come with added perks like rental car collision (LDW) insurance (normally $10 - $30 per day), travel trip delay or lost luggage protection, purchase protection, roadside assistance (~ $99/year value), TSA-Pre (~$100 value every four years), cell phone protection (~$75/year value) and more. These extras may cover the cost of your fee in some cases!

Have you ever done any credit card hacking? Do you already have any of these cards? What is your favorite credit card and why?

This post is part of NaBloPoMo. You can find the rest of my posts for this challenge here. You can find the list of participants and their information here.